20 years old commits suicide after seeing negative balance of $730,000 in Robinhood

Trading application Robinhood is accused of the demise of a 20 years old University student from Chicago.

Robinhood is being sued for the illegitimate passing of a 20-year-old undergrad who kicked the bucket by self-destruction the previous summer after he saw a negative total of $730,000 in his exchanging account and erroneously accepted that was the amount of cash he owed.

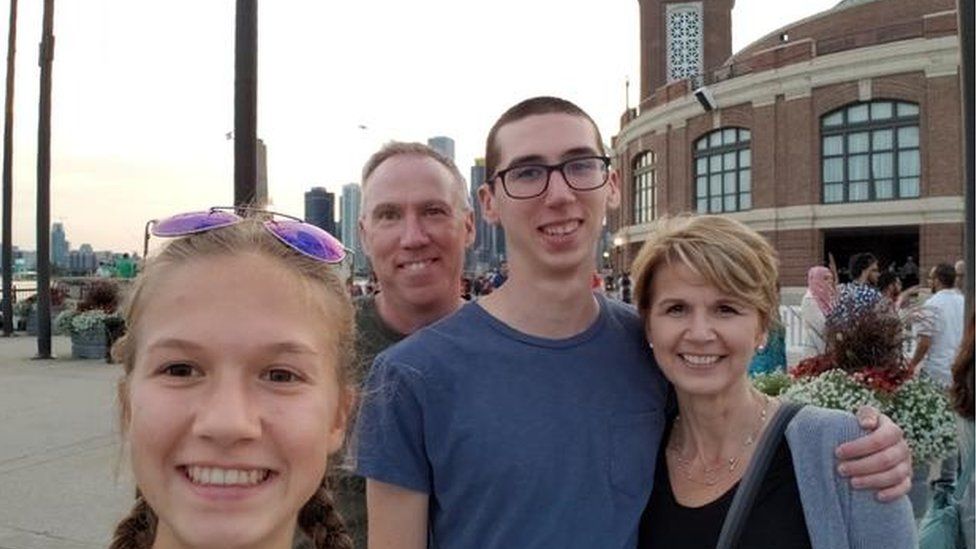

The guardians and sister of Alexander Kearns blamed Robinhood for tricking unpracticed financial backers like their child to face huge challenges in modern monetary instruments, for example, the choices exchanging he occupied with – without giving the essential client service and speculation direction.

“Robinhood worked out its exchanging stage to look similar as a videogame to draw in youthful clients and limit the presence of certifiable danger,” peruses the claim recorded Monday in California by Kearns’ folks Dan and Dorothy and sister Sydney.

Notwithstanding unjust passing, the grievance documented by the Illinois family blames Robinhood for the careless curse of enthusiastic pressure and out of line strategic policies. The harms they are looking for will be resolved sometime in the future.

Those dangers have been additionally amplified as of late with the ascent and fall of GameStop, which was shot by a multitude of dealers on Reddit. Robinhood started shock a month ago by incidentally suspending the acquisition of GameStop (GME) – a dubious advance that provoked Congress to plan hearings.

In an explanation, Robinhood clarified it has made a progression of enhancements to its choices offering, including by giving direction to help clients, reports on how it shows purchasing power and live voice uphold for clients with open alternatives positions.

“We were crushed by Alex Kearns’ passing,” Robinhood said. “We stay focused on making Robinhood a spot to learn and contribute mindfully.”

‘He was in a total frenzy’

Kearns, who began utilizing Robinhood when he was a senior in secondary school, passed on by self-destruction in June in the wake of setting choices spread exchange containing a danger “Alex didn’t comprehend,” as per the claim. His Robinhood account mirrored a negative money total in the measure of $730,000 – definitely more cash than he had, the claim said.

“He was in a total frenzy. His frenzy and franticness developed as he couldn’t convey over various hours with anybody at Robinhood,” the claim said, adding that he consistently fell flat to contact agents at the organization.

Adding to the misfortune, Kearns didn’t understand his enormous negative equilibrium would have been eradicated by the activity and settlement of choices he held, the claim said.

“Robinhood never tried to disclose this to Alex or react to his undeniably edgy supplications for help,” the claim said.

The family stuck the fault for Kearns’ frenzy solidly on Robinhood.

“This brought about a profoundly troubled state of mind in Alex, a wild motivation to end it all as should have been obvious,” they said.

What actions Robinhood took later this incident

Prior to ending his own life, Kearns left a note that flagged his disarray.

“How was a 20-year-old with no pay ready to get doled out nearly $1 million worth of influence,” the note said, as per the claim, adding that these were his last known composed words.

After Kearns’ passing, Robinhood’s prime supporters composed that they were “by and by crushed by this misfortune” and vowed to make enhancements to its application.

Robinhood said for the current week that its progressions incorporate new monetary models and changed experience necessities for new clients looking to exchange progressed alternatives procedures and plans to extend that to other use cases. Robinhood additionally changed its framework to raise messaged uphold demands from certain alternatives merchants.