Cathie Wood Best Stocks

Cathie Wood’s investment approach centers on identifying high-impact innovations. The high-level areas of focus are artificial intelligence, DNA sequencing, robotics, CRISPR gene editing, energy storage, fintech, 3D printing, and blockchain technology. She believes that these technologies have the potential to revolutionize many industries and create significant value for investors. Wood’s investment strategy has been successful in the past, and her funds have outperformed the S&P 500 index. However, her approach is also risky, as it is difficult to predict which innovations will be successful.

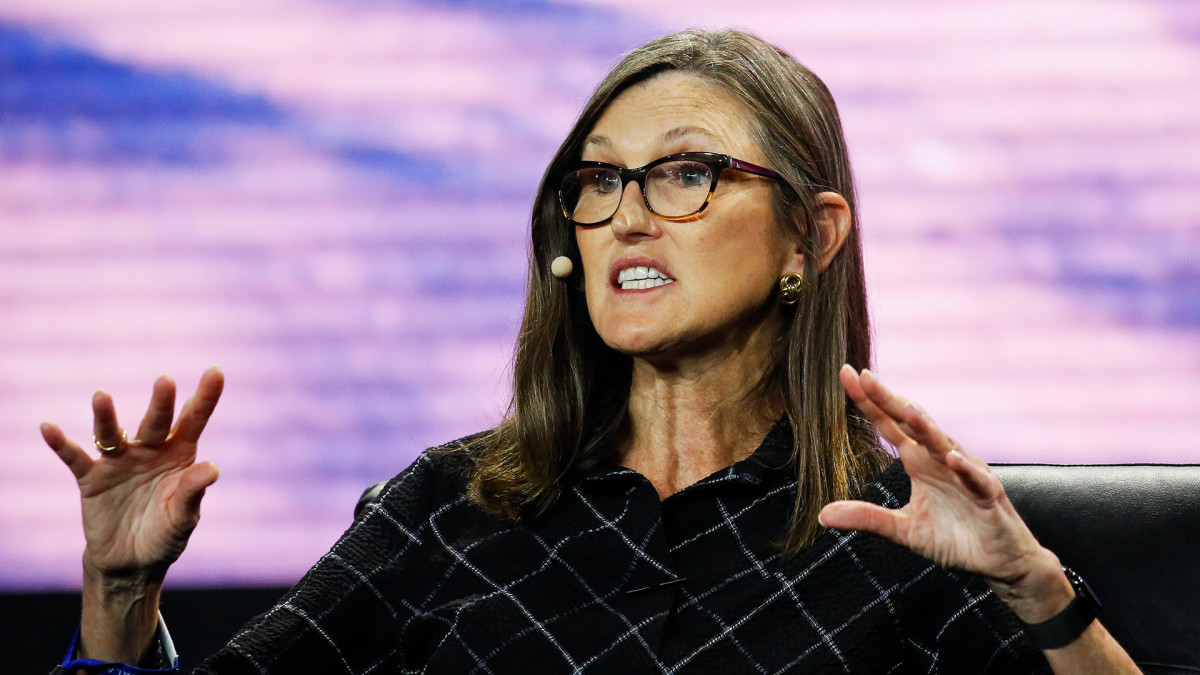

Cathie Wood is the founder and CEO of ARK Invest, an investment management firm that focuses on disruptive innovation. Wood is known for her aggressive investing style and belief in innovative companies’ long-term potential.

In 2023, Wood’s favorite stocks include:

Tesla (TSLA):

Tesla is a leading electric vehicle manufacturer. Wood believes that Tesla is well-positioned to benefit from the growth of the electric vehicle market.

Tesla has been the all-time favorite stock of Cathie Wood. Tesla designs, develops, manufactures, sells, and leases fully electric vehicles and energy generation and storage systems, and offers services related to its products.

Cathie Wood seems very bullish on TSLA and aiming for a target of $2000 per share, a remarkable 1000% gain from its current price.

Roku (ROKU):

Roku, Inc. is a television (TV) streaming platform in the United States, Mexico, and Canada. The Company is engaged in the sale of digital advertising and related services, including demand-side platform and content distribution services such as subscription and transaction revenue shares, media and entertainment promotional spending, the sale of premium subscriptions, and the sale of branded channel buttons on remote controls

Wood believes that Roku is well-positioned to benefit from the growth of the streaming media market.

Coinbase (COIN):

Coinbase is a cryptocurrency exchange. Wood believes that Coinbase is well-positioned to benefit from the growth of the cryptocurrency market.

Cathie Wood has been bullish on Coinbase stock. In an interview with Bloomberg, she discussed why her flagship fund, Ark Innovation, is adding to its position in shares of Coinbase (COIN) after the Securities and Exchange Commission (SEC) sued Binance, one of Coinbase’s biggest competitors. Wood believes that SEC enforcement will lead Coinbase to become the only game in town when it comes to cryptocurrency exchanges in the United States. However, it is important to note that some analysts share her view while others do not. The analyst consensus on the stock is a Hold rating, with an average price target of $58.49. Several notable analysts have come forward with more bullish price targets of $70.

Block (SQ):

Block is a financial technology company that provides payment processing and other services. Wood believes that Block is well-positioned to benefit from the growth of the digital payments market.

Cathie Wood has been bullish on Block (SQ) for some time. On March 23, 2023, she doubled down on Block (SQ) stock, adding 58,233 shares to the ARK Innovation ETF and 9,431 shares to the ARK Next Generation Internet ETF (NYSEARCA: ARKW). The day after her purchase, Hindenburg Research published a short report accusing the mobile payment company of misleading investors by reporting fraudulent user data. It is unclear if the short-seller’s case against the stock will affect Wood’s stance on it.

Cathie Wood’s ARKK funds were big buyers of Block (SQ) stock on March 23, 2023, supporting CEO Jack Dorsey against a short report from Hindenburg Research. Wood’s funds bought 300,000 Block shares while they were falling 15%. The largest fund, ARK Innovation (NYSEARCA: ARKK), bought 275,000 of those shares.

Cathie Wood sees the potential in Block (SQ), which makes sense considering that she is also a fan of cryptocurrency. If she’s right about Block, the stock will rebound and continue to post gains for investors over time.

Teladoc Health (TDOC):

Teladoc Health is a telehealth company. Wood believes that Teladoc Health is well-positioned to benefit from the growth of the telehealth market.

Cathie Wood has been bullish on Teladoc and continues to bet on the company even as the stock plummets. She has compared Teladoc to Amazon and said that investors are missing out on a stock that’s in the “same league” as Amazon. Wood believes that Teladoc is becoming the healthcare information backbone of the U.S. Teladoc is also the largest holding, by percentage, in the ARK Genomic Revolution ETF (ARKG), accounting for 7% of the fund.

Twilio (TWLO):

Twilio Inc (Twilio) is a provider of cloud communications platforms The company’s product portfolio includes voice, video, messaging, authentication, look up, verify, and Twilio engage, and flex. Twilio enables developers to build, scale, and operate real-time communications within software applications.

Cathie Wood appears to be optimistic about Twilio’s future. Twilio is one of Cathie Wood’s top 10 holdings, accounting for just over 4% of the Ark Invest CEO’s popular Ark Innovation ETF¹. Despite the fact that Twilio’s stock has gone south in 2022, with shares down 83% so far this year, Wood still believes in Twilio and sees the stock heading lower on Monday in response to the downgrade as a buying opportunity. She isn’t alone in her optimism, with 10 out of 13 analysts surveyed in July by Refinitiv rating Twilio as either a buy or a strong buy. Although Wood has shown a keen interest in Twilio, it is unlikely that she views it as a more magnificent growth stock than Tesla.

CRISPR Therapeutics AG (CRSP):

CRISPR is a technology for gene editing, the process of precisely altering specific sequences of genomic DNA. The Company aims to apply this technology to disrupt, delete, correct, and insert genes to treat genetically-defined diseases and to engineer advanced cellular therapies.

On May 10, 2023, ARK Innovation ETF made two sales of CRISPR Therapeutics stock, dumping more than 249,500 shares. Despite this sale, CRISPR Therapeutics appears to be the gene-editing stock that Wood is most bullish about. Her ARK Innovation ETF owns nearly 5.5 million shares of the biotech, making it the fund’s 12th-largest position. It is important to note that the opinions and actions of investors like Cathie Wood are not necessarily indicative of future stock performance and it is always important to conduct your own research and due diligence before making any investment decisions.

Shopify (SHOP):

Shopify is a user-friendly e-commerce platform that helps small businesses build an online store and sell online through one streamlined dashboard.

Cathie Wood recently doubled down on Shopify stock while selling a portion of her stake in Coinbase. Macroeconomic uncertainty has been a negative factor for the growth of many businesses, but Shopify and Coinbase Global have really felt the bite of the bear market. Wood believes that Shopify can be the next Amazon and has been buying the recent dip in the e-commerce stock. Generally speaking, the best time to buy a stock is when it’s down. That seems to be the view Cathie Wood is taking with Shopify, having bought shares after they dipped on Thursday’s disappointing forward-looking guidance. Wood’s perspective on Shopify is clearly long-term.

PagerDuty (PD):

PagerDuty, Inc. is a digital operations management platform that manages urgent and mission-critical work for a modern, digital business. The Company collects data and digital signals from virtually any software-enabled system or device and leverages machine learning to correlate, process, and predict opportunities and issues.

Cathie Wood has been increasing her stakes in PagerDuty, an American cloud computing firm that offers a digital operations management platform. Wood has been picking up some shares on the cheap. This month, she purchased 971,668 PD shares via the ARKK fund. In total, ARKK now holds 7,954,868 shares, currently worth $172.54 million. Wood’s position in PagerDuty is currently worth $257 Million. That’s 1.51% of their equity portfolio (the 20th largest holding). Wood owns a total of 11.29% of the outstanding PagerDuty stock.

Vertex Pharmaceuticals (VRTX):

Vertex Pharmaceuticals Incorporated is a global biotechnology company. The Company is focused on developing medicines that treat the underlying cause of cystic fibrosis (CF).

Cathie Wood has been increasing her stakes in Vertex Pharmaceuticals, an American biotech company that specializes in cystic fibrosis treatment. The stock is among the top 10 holdings in the ARK Genomic Revolution ETF. Wood has been picking up some shares on the cheap. In total, ARKK now holds 7,954,868 shares, currently worth $172.54 million. Wood’s position in Vertex Pharmaceuticals is currently worth $257 Million. That’s 1.51% of their equity portfolio (the 20th largest holding).

The investor owns 11.29% of the outstanding Vertex Pharmaceuticals stock. It seems that Cathie Wood sees potential in Vertex Pharmaceuticals and is confident in its future growth

These are just a few of Cathie Wood’s favorite stocks in 2023. It is important to note that Wood’s investment style is aggressive and her picks are not always successful. Investors should do their own research before investing in any of these stocks.

Even though, Cathie Wood is a fantastic and globally renowned investor. Still, it is your duty to do your own research before investing in any of these stocks. Thank you so much for watching. Dont forget to subscribe to the channel.